When a business partner or contractual counterparty fails to fulfill its financial obligations, creditors must follow a clearly defined legal framework for debt collection in Serbia in order to recover outstanding claims lawfully and efficiently.

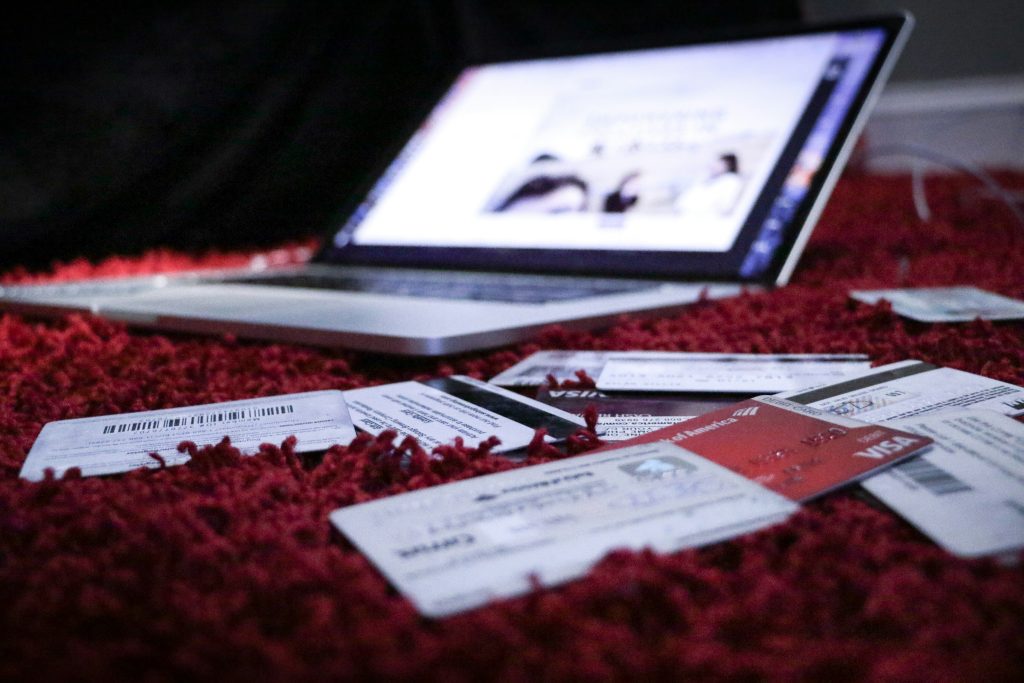

Monetary claims in commercial relationships most often arise from unpaid invoices, bills of exchange, loan agreements, service contracts, court judgments, or arbitration awards. Serbian law provides several legally recognized methods of debt collection in Serbia, ranging from out-of-court negotiations and formal payment demands to court proceedings and enforcement actions. The appropriate approach depends on the type of claim, the debtor’s status, and the available documentation. Whether the matter involves overdue invoices or the enforcement of a final court decision, understanding the rules governing debt recovery in Serbia is essential.

This guide provides a structured overview of debt collection in Serbia, including the applicable laws, available procedures, and practical steps creditors must take. It explains what constitutes an enforceable debt, how to properly prepare and submit documentation, and which legal mechanisms apply to different types of claims. By understanding the legal and procedural aspects of debt collection in Serbia, creditors can significantly increase their chances of successful recovery while remaining fully compliant with Serbian regulations.

Understanding Enforceable Debt in Serbia

For effective debt collection in Serbia, understanding the legal framework for enforceable debts is essential. The Serbian enforcement system operates on clearly defined principles regarding what constitutes a valid claim and which documents can serve as a basis for enforcement proceedings.

Definition of matured claims under Serbian law

Under Serbian law, a prerequisite for initiating debt collection in Serbia is that the creditor’s claim against the debtor has legally matured. A claim is considered matured only after the payment deadline stated in the invoice or contract has expired without the debtor fulfilling the obligation. For this reason, proper preparation of documentation is a critical first step in debt collection in Serbia, as creditors must issue invoices that contain all mandatory legal elements and ensure they are duly delivered to the debtor.

Once the agreed payment period elapses without settlement, the claim formally matures and the creditor becomes entitled to initiate further legal steps for debt collection in Serbia, including out-of-court demands, court proceedings, or enforcement actions. From that moment, the debtor is liable not only for the principal amount but also for statutory default interest, calculated in accordance with Serbian regulations, which continues to accrue until full payment is made.

The legal foundation for all debt collection in Serbia proceedings is set out in the Law on Enforcement and Security (LES), which defines a “claim” as the right of a judgment creditor to request from a judgment debtor a specific performance, act, omission, or tolerance. This statutory definition establishes the basis on which all enforcement and recovery mechanisms in debt collection in Serbia operate.

What qualifies as an enforceable document

Serbian law makes a clear distinction between different types of documents that can serve as a basis for enforcement. According to the LES, enforceable documents (izvršne isprave) include:

- Enforceable court decisions (judgments and rulings) or court settlements ordering performance or non-performance

- Final decisions rendered in misdemeanor or administrative proceedings

- Extracts from the Pledge Register and Financial Leasing Register

- Mortgage contracts and pledge statements

- Reorganization plans in bankruptcy procedure confirmed by court ruling

- Notary documents with enforceable power

- Agreements on dispute resolution through mediation that fulfill legal requirements

- Constitutional Court decisions upholding damage claims

- Other documents designated as enforceable by law

For the purpose of debt collection in Serbia, a court decision may be enforced only once it has been formally confirmed as final and enforceable by the competent court, usually by affixing official confirmation stamps to the original decision. This formal confirmation is a mandatory prerequisite for initiating enforcement proceedings in debt collection in Serbia.

In addition, the voluntary compliance period granted to the debtor in the court decision must have expired without performance. Only after the lapse of this period may the creditor proceed with compulsory enforcement as part of the debt collection in Serbia process. Where a judicial decision is subject to a condition, it becomes enforceable exclusively upon fulfillment of that condition, after which the creditor may lawfully initiate enforcement measures under the Serbian enforcement regime.

Difference between enforceable and valid documents

A crucial distinction exists between enforceable documents (izvršne isprave) and valid or authentic documents (verodostojne isprave). This differentiation significantly impacts the debt collection approach in Serbia.

Enforceable documents, as detailed above, directly enable the initiation of enforcement proceedings. In contrast, valid documents serve as evidence of a debt but may require additional steps before enforcement can begin.

Valid documents recognized under Serbian law include:

- Promissory notes and checks (with protest if required)

- Invoices (accompanied by delivery notes or proof of debtor notification)

- Extracts from business records for utility services

- Bank guarantees and letters of credit

- Interest calculations with evidence of claim maturity

- Temporary or final construction work completion certificates

For a document to be suitable for enforcement in the context of debt collection in Serbia, it must contain all legally prescribed elements, including clear identification of both the creditor and the debtor, as well as precise information on the object, type, scope, and maturity of the obligation. These formal requirements are essential, as enforcement authorities rely exclusively on the content of the document when conducting debt collection in Serbia proceedings.

Where the document does not explicitly state the maturity date of the obligation, the creditor must provide written evidence that the debtor was granted an additional deadline for voluntary performance. Only upon expiry of that additional period does the claim become enforceable for the purposes of debt collection in Serbia.

If a creditor does not possess either an enforceable or a formally valid document, the only available route is to first initiate civil litigation in order to obtain a court judgment. Such judgment then becomes the legal basis for enforcement and subsequent debt collection in Serbia. The distinction between enforceable, valid, and non-enforceable documents is therefore critical, as the nature of the document directly determines the legal pathway available for recovering outstanding claims under Serbian law.

Debt Collection from Invoices and Business Records

Invoices represent one of the most common legal foundations for debt collection in Serbia. As authentic documents under Serbian law, properly issued invoices allow creditors to initiate debt collection in Serbia directly through enforcement proceedings, without the need to first obtain a court judgment, provided that all statutory requirements are met.

This makes invoices a particularly efficient instrument for debt collection in Serbia, as they enable creditors to bypass lengthy litigation and proceed immediately to enforcement, subject to formal validity and proper delivery to the debtor.

Invoice requirements under the Law on Enforcement

The Law on Enforcement and Security Interest establishes precise criteria for invoices to qualify as valid enforcement documents. For an invoice to serve as a basis for initiating enforcement proceedings, it must contain several essential elements:

- Complete information identifying the enforcement creditor (the party owed money)

- Clear details about the enforcement debtor (the party owing money)

- Specific information regarding the subject of the obligation

- The type and scope of the debtor’s obligation

- A clearly defined due date for payment

Invoices represent one of the most common legal foundations for debt collection in Serbia. As authentic documents under Serbian law, properly issued invoices allow creditors to initiate debt collection in Serbia directly through enforcement proceedings, without first obtaining a court judgment, provided that all statutory conditions are fulfilled.

This makes invoices a particularly efficient tool for debt collection in Serbia, as they enable creditors to bypass time-consuming litigation and proceed immediately to enforcement, subject to formal validity, proper delivery, and compliance with mandatory legal requirements.

Delivery note and proof of debtor notification

Prior to initiating enforcement proceedings as part of debt collection in Serbia, creditors must verify that the debtor was properly notified of the payment obligation. This notification requirement represents a mandatory legal precondition for enforcement based on invoices and is strictly reviewed in debt collection in Serbia proceedings.

Where goods or services are delivered together with a signed delivery note attached to the invoice, such document automatically satisfies the notification requirement. The signed delivery note serves as written evidence that the debtor received both the goods or services and the related payment obligation, thereby enabling debt collection in Serbia to proceed without additional proof.

If no delivery note exists or it has not been properly signed, the creditor must submit alternative written evidence demonstrating that the debtor was informed of the payment obligation. This proof of notification is mandatory and must be filed together with the enforcement proposal in debt collection in Serbia proceedings.

Since 2021, Serbia has introduced a mandatory electronic invoicing system that has significantly simplified this aspect of debt collection in Serbia. Under this system, an electronic invoice is legally deemed delivered at the moment of issuance, eliminating the previous requirement to prove delivery by registered mail and substantially reducing both time and administrative costs.

Sending a written warning before enforcement

Following the maturity of a claim, creditors should send the debtor a formal written warning before initiating enforcement proceedings. This pre-enforcement notice typically:

- Reminds the debtor of their unpaid obligation

- Specifies a new deadline for voluntary payment (usually a few days)

- Clearly states that enforcement proceedings will commence if payment isn’t made within the specified period

- May include a calculation of the principal amount plus any accrued interest and costs

The written warning serves several important functions in debt collection in Serbia. First, it provides the debtor with a final opportunity to voluntarily settle the outstanding obligation, potentially avoiding the additional costs and consequences associated with enforcement proceedings. Second, it creates documentary evidence that the creditor attempted an amicable resolution before initiating formal debt collection in Serbia measures.

In practice, however, debtors frequently dispute or ignore such warnings. When this occurs, creditors are left with no alternative but to proceed with formal enforcement actions as part of debt collection in Serbia.

Judicial Enforcement Procedure for Unpaid Claims

When amicable attempts at debt collection fail, Serbian law provides a structured judicial pathway for enforcing unpaid claims. The Law on Enforcement and Security establishes a comprehensive framework for compelling debtors to fulfill their monetary obligations through formal legal proceedings.

Filing a proposal for enforcement with the court

Initiating the enforcement procedure requires submitting a proposal for enforcement to the competent authority. The jurisdiction depends on the nature of the claim:

- Basic or commercial courts have first-instance jurisdiction for deciding on enforcement motions

- Public enforcement officers have exclusive jurisdiction for enforcing valid documents related to monetary claims from utility services

- Commercial courts handle abbreviated enforcement proceedings for specific documents like promissory notes and invoices

Generally, the court with territorial jurisdiction is the one where the enforcement debtor has permanent or temporary residence, or registered headquarters. Upon receiving the proposal, the court reviews whether all legal requirements are satisfied before issuing an enforcement decision.

The 2019 amendments to the enforcement law introduced optional preliminary stages, including digital filing of enforcement motions and a voluntary settlement process.

Mandatory elements of the enforcement proposal

A properly drafted enforcement proposal must contain several essential elements to be accepted by the court:

- Identification details – Complete and accurate information about both the creditor and debtor (different requirements apply for individuals versus legal entities)

- Valid document specification – Clear indication of the authentic or enforceable document forming the basis for the claim

- Claim details – Precise information about the nature and amount of the creditor’s claim

- Enforcement means and objects – Specification of assets or items targeted for enforcement, or alternatively, a request for enforcement against all the debtor’s property

- Public enforcer designation – Identification of the locally competent bailiff who will execute the enforcement

- Payment deadline request – A request that the court obligate the debtor to settle the claim within eight days

- Attachments – Original invoice, certified copy, or transcript (with certified translation if issued by a foreign entity)

After analyzing all these elements, the court issues an enforcement decision that specifies the enforcement measure and object. If multiple enforcement instruments and subjects were requested, all may be included in the order.

Role of the public enforcer in execution

Public enforcement officers (bailiffs) play a central role in Serbia’s debt collection system. Upon receiving the enforcement decision, these trained officials implement the actual collection procedure by:

- Executing the ordered means of enforcement on specific subjects

- Blocking debtor’s bank accounts through the National Bank of Serbia when monetary claims are involved

- Identifying and examining debtor’s assets and, if necessary, seizing them

- Liquidating seized assets when required to satisfy the claim

- Transferring seized funds to the creditor’s account

The 2019 amendments to Serbian enforcement legislation also introduced digital public auctions as part of debt collection in Serbia, initially on an optional basis from March 2020 and becoming mandatory as of September 2020. These electronic auctions significantly increased transparency and efficiency in the sale of debtors’ assets within the debt collection in Serbia enforcement framework.

Public enforcement officers are authorized to limit enforcement measures to funds and assets sufficient to satisfy the creditor’s claim, in accordance with the statutory principle of proportionality and cost reduction applicable to debt collection in Serbia. Once adequate funds have been secured, the enforcement officer issues a formal decision terminating the enforcement procedure.

Following receipt of this decision, the creditor may submit a request for reimbursement of enforcement costs within eight days.

Debt Collection Based on Promissory Notes

Promissory notes offer creditors in Serbia a powerful debt collection tool with distinct advantages over other enforcement documents. These financial instruments serve as authentic documents under the Law on Enforcement and Security, enabling creditors to initiate enforcement proceedings directly based on the promissory note itself.

Filling out and submitting a bill of exchange

The process of enforcing promissory notes as part of debt collection in Serbia begins with their proper registration. Creditors must first complete a registration form available at any commercial bank, after which the promissory note is entered into the registry maintained by the National Bank of Serbia. For a promissory note to serve as valid security in debt collection in Serbia, the parties must have expressly agreed that it will be used as a means of securing payment of the underlying obligation.

In practice, most promissory notes in Serbia are issued as blank promissory notes containing a “no protest” clause. The creditor is authorized to complete such notes once the debtor’s obligation becomes due. This mechanism significantly accelerates debt collection in Serbia, as it allows the creditor to proceed directly to enforcement without granting the debtor an additional payment deadline.

As of 1 December 2025, Serbia will introduce a fully digitalized system for promissory notes through the Central Register of Electronic Promissory Notes (CReM), administered by the National Bank of Serbia. This reform represents a major modernization of debt collection in Serbia, as it replaces paper-based promissory notes with a secure digital system, eliminates the need for physical documentation, and removes the requirement for bank visits, thereby further streamlining enforcement procedures.

Judicial vs. bank-based collection of promissory notes

Promissory notes in Serbia offer two distinct collection pathways: judicial enforcement through courts or direct bank-based collection. Each method has unique requirements and advantages.

The judicial collection process follows the standard enforcement procedure with several notable advantages:

- No requirement to notify the debtor beforehand about obligation maturity

- Enforcement decisions based on promissory notes execute before becoming legally binding

- A shorter voluntary payment period of five days (versus eight for other documents)

- Debtor objections do not delay enforcement implementation

In essence, bank-based collection (“Fast payment”) represents a much quicker alternative, often completing within 2-3 days or sometimes the same day. Nevertheless, this method requires precise documentation that many creditors lack unless they planned accordingly when establishing the business relationship.

For bank-based collection, creditors must submit:

- Statement of Guarantee (signed by debtor)

- Covering Letter (specifying the claim and associated promissory note)

- Order for fund transfer

- Declaration of the submitted collection order

Critically, promissory notes must be submitted to the debtor’s business bank within two days after the due date, per the Bill of Exchange Act. If a commercial bank refuses execution through account enforcement (a relatively common occurrence), the court enforcement route becomes essential.

No protest clause and its legal implications

The process of enforcing promissory notes as part of debt collection in Serbia begins with their proper registration. Creditors must complete a registration form available at any commercial bank, after which the promissory note is entered into the registry maintained by the National Bank of Serbia. For a promissory note to serve as valid security in debt collection in Serbia, the parties must have expressly agreed that it will be used to secure payment of the underlying obligation.

In practice, most promissory notes in Serbia are issued as blank promissory notes containing a “no protest” clause. The creditor is authorized to complete such notes once the debtor’s obligation becomes due. This mechanism significantly accelerates debt collection in Serbia, as it allows the creditor to proceed directly to enforcement without granting the debtor an additional payment deadline.

As of 1 December 2025, Serbia will introduce a fully digitalized system for promissory notes through the Central Register of Electronic Promissory Notes (CReM), administered by the National Bank of Serbia. This reform represents a major modernization of debt collection in Serbia, replacing paper-based promissory notes with a secure digital platform and eliminating the need for physical documentation or bank visits, thereby further streamlining enforcement procedures.

Enforcement of Claims from Contracts and Agreements

Contracts represent the most widespread foundation for monetary claims in Serbian business relationships. Although they form the basis of countless financial obligations, the path from a signed agreement to actual debt collection follows specific legal parameters.

When a contract becomes a basis for enforcement

In the Serbian legal system, contracts alone typically cannot directly serve as enforceable documents, unlike promissory notes or court judgments. This represents a crucial distinction for creditors pursuing debt collection. Ordinary contracts, even when properly drafted and signed, generally require additional legal steps to become enforceable.

In particular, for a contract to become directly enforceable, it must meet specific formal requirements:

- It must be prepared in the form of a notarial deed

- It must contain explicit enforcement clauses that clearly define the payment obligations

- Both parties must expressly consent to direct enforcement in case of default

Without these elements, creditors must first obtain a court judgment confirming the validity of their claim before enforcement can begin. This two-step process often extends the timeline for debt recovery, making preventative measures in contract drafting particularly valuable.

Importance of clearly defined payment terms

Given the statutory constraints on payment periods in Serbia, contracts should precisely define payment terms that comply with legal requirements. Serbian law mandates that private undertakings must pay their invoices within 60 calendar days. After this period, the payment becomes legally overdue.

For transactions involving public authorities, the maximum payment period is even shorter – 45 days. Of course, exceptions exist, such as:

- Transactions with the National Healthcare Fund (up to 90 days)

- Contracts with bank guarantees containing specific legal language

- Payment in installments (up to 90 days, with at least 50% paid by mid-term)

Still, any contractual provisions that exceed these statutory limits become automatically null and void under Serbian law. Additionally, failing to meet monetary obligations within stipulated terms triggers significant consequences:

- Creditors can claim a fixed compensation of 20,000 RSD (approximately €170)

- Late payment constitutes a misdemeanor with potential fines between 100,000-2,000,000 RSD for companies

- Responsible individuals may face personal penalties of 5,000-150,000 RSD

Court judgment as a prerequisite for enforcement

Indeed, most contracts require judicial validation before becoming enforceable documents. As a result, creditors typically must initiate litigation to obtain a court judgment when debtors fail to fulfill contractual obligations.

After completing evidentiary procedures and main hearings, the resulting court decision becomes the legal foundation for enforcement. Even then, a judgment only becomes enforceable after two conditions are met:

- The decision must become final and binding (no further appeals possible)

- The deadline for voluntary fulfillment specified in the judgment must expire

This process underscores the importance of proper contract drafting from the outset. A well-constructed agreement with clearly defined obligations creates a stronger position in court, potentially accelerating the path to obtaining an enforceable judgment. Meanwhile, vague terms or ambiguous language often lead to protracted legal battles.

Although this judicial prerequisite may seem burdensome, it serves an important function in the Serbian legal system by ensuring claims undergo proper scrutiny before enforcement mechanisms are activated.

Court Judgments and Arbitration Awards as Enforcement Basis

Court judgments and arbitration awards form the strongest legal basis for debt collection in Serbia, offering creditors the highest level of certainty in enforcement proceedings. These documents carry substantial legal weight within the Serbian enforcement system, especially compared to other enforcement bases like invoices or contracts.

Legal enforceability of court and arbitration decisions

Serbian courts typically issue two types of decisions in civil matters: rulings and judgments. Rulings handle procedural matters and can impose measures, whereas judgments represent decisions on the merits of a dispute.

Based on the nature of relief granted, judgments in Serbia fall into three distinct categories:

- Condemnatory judgments order performance or non-performance of specific actions. These judgments are fully eligible for enforcement.

- Constitutive judgments establish, amend, or nullify rights or legal relationships. They automatically become effective once final, requiring no enforcement.

- Declaratory judgments clarify the existence or non-existence of rights or legal relationships. While not directly enforceable, they can evidence rights in other proceedings.

Similarly, arbitration awards carry equivalent enforcement weight as court decisions in Serbia. Given Serbia’s membership in the New York Convention since 1981, international arbitration awards enjoy recognition through a relatively straightforward process.

Conditions for initiating enforcement from judgments

For a judgment to serve as a valid basis for debt collection in Serbia, it must satisfy several mandatory legal conditions. First, the court decision must be formally confirmed as final and enforceable by the competent court, typically by affixing official confirmation stamps to the original copy. Second, the voluntary compliance period granted to the debtor in the judgment must have expired without performance. Only when both conditions are met may the creditor initiate enforcement as part of debt collection in Serbia.

The enforcement procedure formally begins when the creditor files a motion for enforcement with the competent court. This submission must clearly identify the judgment on which enforcement is based and include all required supporting documentation. Upon receipt, the court examines whether the statutory requirements for debt collection in Serbia are fulfilled before issuing a decision allowing enforcement to proceed.

Where enforcement is sought on the basis of a foreign judgment, an additional recognition procedure (exequatur) is mandatory. In this process, Serbian courts assess the foreign decision’s validity and its compatibility with Serbian law. Once recognized, the foreign judgment produces legal effects in debt collection in Serbia from the date on which it was originally rendered, rather than from the date of recognition.

Enforcement decision vs. finality of judgment

A critical distinction exists between a judgment becoming final and becoming enforceable. A judgment becomes final when no further regular legal remedies (appeals) are possible. This finality is confirmed through a “finality clause” stamped on the decision.

Conversely, a judgment becomes enforceable only after two conditions are satisfied: it has become final and binding, plus the deadline for voluntary fulfillment has expired. At this point, the court attaches an “enforceability clause” to the decision.

Certain exceptions exist where judgments can be enforced before becoming final. For instance, decisions on temporary measures and enforcement based on bills of exchange may be executed immediately. Nevertheless, review and renewal procedures are not permitted against final decisions in enforcement proceedings.

In commercial disputes, creditors benefit from an expedited process where the enforcement decision can be issued within eight days of filing the motion. This efficiency represents a key advantage for businesses seeking to collect debts through court judgments in Serbia.

Cost Recovery and Legal Fees in Enforcement

The financial aspects of debt collection in Serbia require careful consideration, particularly regarding cost allocation between parties. Understanding these financial responsibilities enables creditors to plan accordingly throughout enforcement proceedings.

Advance payment obligations for creditors

Creditors must pay enforcement costs in advance, providing funds before proceedings commence. These advance payments cover court fees, debt collection lawyer fees, and anticipated public bailiff expenses. Without these advance payments, enforcement proceedings face discontinuation. Importantly, creditors exempt from court fees are not required to make advance payments; in such cases, the enforcement debtor bears these costs directly.

Requesting reimbursement of enforcement costs

After receiving the conclusion of enforcement, creditors have exactly eight days to submit a request for reimbursement of enforcement costs. This request is essential because, obviously, creditors incur various expenses throughout the enforcement procedure. Upon creditor request, the public bailiff orders the debtor to reimburse all necessary enforcement costs. Failure to file this request within the specified timeframe results in forfeiture of cost recovery rights.

Public enforcer compensation structure

Public enforcers receive compensation through a three-tiered fee structure:

- Initial advance covering case preparation, management, and archiving

- Fees for individual enforcement actions taken

- Success fee calculated based on claim amount actually collected

Overall, the debtor ultimately bears all justifiable enforcement expenses, thereby ensuring creditors can recover legitimate costs incurred during successful collection efforts.

Conclusion

Navigating debt collection in Serbia undoubtedly requires thorough understanding of the local legal framework and procedural nuances. Throughout this guide, we examined the multifaceted aspects of Serbian debt recovery, from identifying enforceable documents to executing collection procedures.

The distinction between enforceable and valid documents fundamentally shapes collection strategies. Enforceable documents like court judgments provide direct access to enforcement, whereas valid documents such as invoices typically require additional steps. Additionally, proper preparation and submission of invoices with all legally required elements significantly increases collection success rates.

Public enforcers play a crucial role within the Serbian collection system, essentially serving as the operational arm of enforcement decisions. Their involvement transforms theoretical legal rights into practical financial recovery. Likewise, promissory notes offer creditors distinct advantages through expedited collection pathways, either judicially or through bank-based mechanisms.

Contracts generally require judicial validation before becoming enforceable, hence highlighting the importance of clear payment terms from the outset. Court judgments and arbitration awards certainly provide the strongest legal basis for collection, though foreign judgments must undergo recognition through the exequatur process.

Serbian law balances creditor recovery rights with debtor protections through a structured objection system. These objections can potentially transform enforcement proceedings into full civil litigation. Furthermore, creditors must carefully manage costs throughout the process, from advance payments to reimbursement requests filed within strict deadlines.

The effectiveness of debt collection ultimately depends on selecting the appropriate enforcement pathway based on available documentation. Creditors should therefore consider preventive measures when establishing business relationships, particularly securing promissory notes or notarized contracts with direct enforcement clauses. Such foresight can dramatically reduce collection timeframes and increase recovery rates when payment issues arise.

Serbian debt collection law continues evolving, particularly with the forthcoming digitalization of promissory notes through the Central Register system. These developments aim to streamline collection processes while maintaining legal protections for all parties involved. Armed with this knowledge, businesses operating in Serbia can confidently navigate debt recovery challenges while remaining compliant with local requirements.